“An investment operation is one which, upon thorough analysis, promises safety of principal and a satisfactory return. Operations not meeting these requirements are speculative”

~ Benjamin Graham

1. Building Your Value Investing Universe: A Step-by-Step Guide

This article outlines a step-by-step process for building your “circle of competence” or “universe of stocks” based on Benjamin Graham’s value investing principles. By focusing on specific criteria and excluding certain industries, you can create a targeted list of potentially undervalued companies for further analysis.

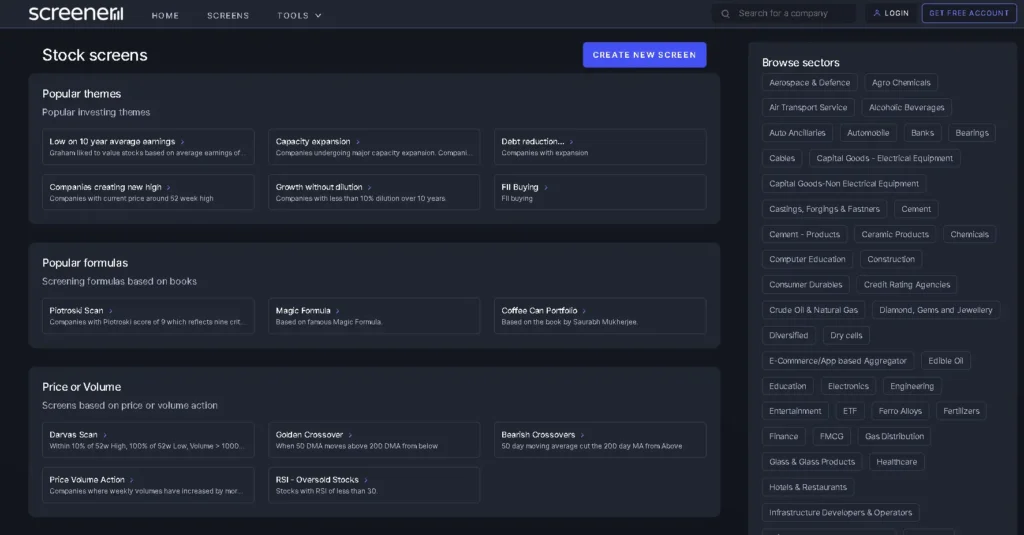

To filter out companies based on Graham’s Principals, you can use any software, application or website you like or prefer, we recommend using https://www.screener.in for filtering out companies and making your own screen.

To create new screen, go to “Create new screen” tab.

1. Define Your Investing Universe with Screener.in

- Market Capitalization: Filter for companies with a market cap between ₹2,000 crore and ₹75,000 crore to focus on medium-sized businesses.

- Financial Strength: Look for companies with a PE ratio between 1.0 and 16, indicating potential undervaluation, and an interest coverage ratio above 4.0 demonstrating strong debt management.

- Liquidity and Solvency: Ensure current assets are at least 1.5 times current liabilities, indicating sufficient short-term liquidity, and maintain a debt-to-equity ratio below 0.3, signifying manageable debt levels.

To enter these assumptions on screen: - Market Capitalization > 2000 AND

- Market Capitalization < 75000 AND

- Sales > 250 AND

- Debt to equity <0.3 AND

- Current ratio > 1.5 AND

- Interest Coverage Ratio >4 AND

- Price to Earning <16 AND

- Return on equity >15 AND

- Dividend yield > 0.5

Exclusions: Avoid investing in finance companies, banks, laboratories, and airlines due to their complex financial structures and potential for rapid value fluctuations.

Finance company’s value can change overnight and the potential losses would not be available for retail investor to see until company releases its quarterly or annual reports, which by the time, it is too late.

And Graham also recommends not to buy companies which are too hard to understand and their advantages(“moat”) or disadvantages are unclear over long-term period.

2. Deep Dive into Individual Companies:

- Start with the Cheapest: Begin by analysing companies with the lowest PE ratio within your screened universe.

- Liquidity Check: Verify that the current ratio remains above 1.5 or 2.0 for healthy short-term liquidity.

- Industry Comparison: Compare the company’s financial metrics with its industry peers to identify relative strengths and weaknesses.

- Consolidated financial Statements: Go through company’s recent annual reports and look through company’s consolidated financial statements and notes of them, for further quantitative analysis. You should know company’s weak and strong points.

- Management & Future Prospects: Scrutinize the annual report, particularly management’s commentary and future outlooks, to assess long-term potential, and what the management has to say about company’s future.

- Valuation Assessment: Determine whether the current stock price reflects accurate value (undervalued, fairly valued, or overvalued) based on your analysis.

- For my value-investing book recommendations, check out : https://r1hedge.com/book-recommendations/

Investment Decisions:

- If Undervalued: Consider this company for long-term (5-15 years) or short-term (1-3 years) investment based on its future prospects and your investment goals.

- If Fairly Valued: Assess whether the future potential outweighs the current price for long-term holding.

- If Overvalued: Avoid this company and wait for better opportunities. Remember, patience is key in value investing.

Conclusion

Building your investment universe and analysing individual companies takes time and effort. Don’t rush into investments; wait for the right opportunities that align with your criteria and valuation principles. By following this process and focusing on value, you can increase your chances of success in the stock market.

Here’s what Peter Lynch has to say about How to value Stocks:

Remember, this is just a guide based on Graham’s Principals, and you should always conduct your own research and due diligence before making any investment decisions. This article is based on our own expertise and experiences and we never try to provide any investment advice. We are not SEBI registered financial analysts. And we are not Liable for any profit or losses you have based on information provided in this article. For more details, check out our legal page-

https://r1hedge.com/legal

This is very interesting, You are an overly professional blogger. I’ve joined your rss feed and sit up for looking for more of your wonderful post. Additionally, I have shared your site in my social networks!

Pingback: Fundamental Analysis of Canara Bank, DCF Model | R1Hedge - R1Hedge