Date: 12/08/24

DCF Model Created and Article written by Rishabh Jain

Cases & Assumptions:

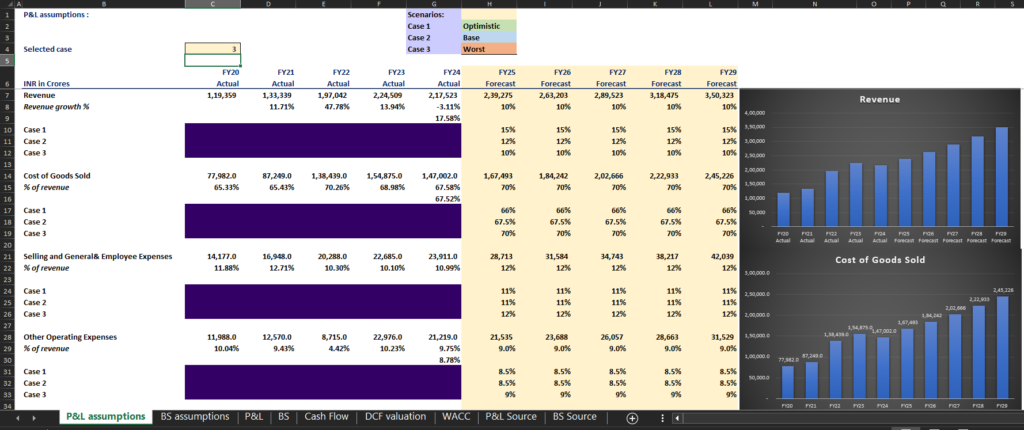

| Cases | 1 | 2 | 3 |

| Revenue Growth% | 15% | 12% | 10% |

| Depreciaiton&Amortisation (%Growth) | 4.00% | 3.85% | 3.60% |

| COGS (%Revenue) | 66% | 67.5% | 70% |

| Current Assets (Growth%) | 8% | 7.6% | 7% |

| Current Liabilities (Growth%) | 12% | 10% | 8% |

| Terminal Value (Growth%) | 1.5% | 1.5% | 1.5% |

Discounted Cash-Flow Model:

Download File :

File Includes:

- Forecasts on Revenue, COGS, R&D Expenses, Depreciation& Amortisation

- Forecasts on Current Assets & Current Liabilities.

- Calculation of Working Capital, CAPEX, Free Cash-Flows.

- Calculation of Weighted Average Cost of Capital.

- Calculation of DCF Intrinsic Value per share of the company.

- Added Graphs for Visualisation of the data.

Summary & Notes:

- HINDALCO Industry Limited is one of India’s Largest Companies, it mainly Deals with Manufacturing and Distribution of Aluminium, Copper and their Products across the globe. It has Market Cap of around 1.41 Lakh Crore with Total Assets of 2.3 Lakh Crore.

- Company has Debt/Equity Ratio of 0.53, which means it is moderately Leveraged. This is very much manageable since Company has Interest Coverage Ratio of 4.65, which indicates company will have no problem with the debt and Long-Term Prospects looks good.

- Company has Current Ratio of 1.33, which indicates good Working Capital Balance, 1.33 times Current assets than Current Liabilities. Company has no short-term Problems with Debt.

- Company has PE ratio of 14, which makes it fairly Valued to Undervalued scenario, since PE ratio of other companies in Industry is much higher.

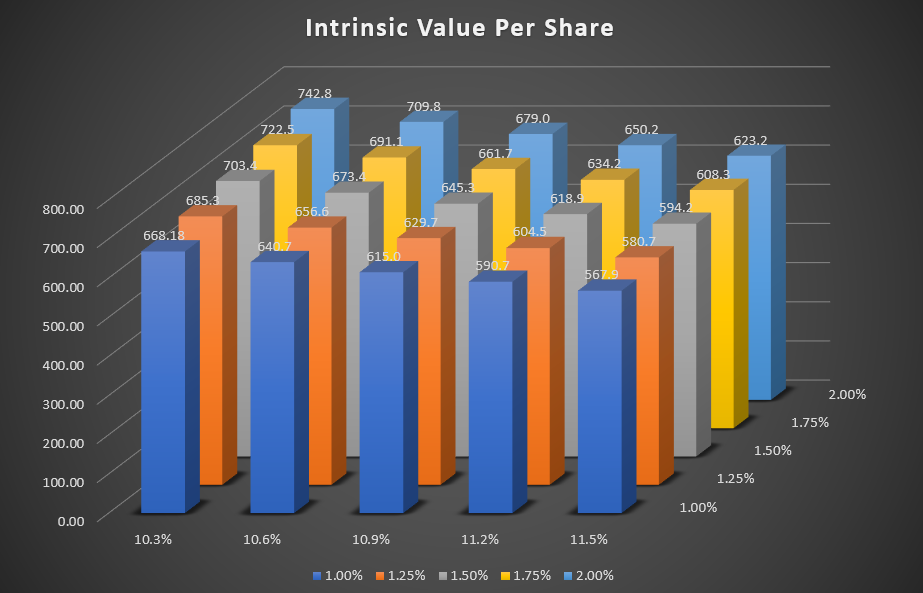

- WACC came out to be 10.9%, which is pretty decent for this company, it can be lower in future years.

- Intrinsic Value per share came out to be Rupees 646, in Worst Case Scenario. Current market price is around 630, which indicates Market is not very optimistic about Future Growth prospects of the company and Aluminium Industry in general. Intrinsic Value per share in Base case scenario is around 1008 Rupees.

Disclaimer:

This DCF Model is for Educational and Research purposes ONLY. The DCF model was based on several Assumptions, and it doesn’t Guarentee it will happen in future. This is not in any form a Financial Advice. Do your own Due-Diligence for Investing. For more details visit our Legal Page –https://r1hedge.com/legal/