Date : 09/08/2024

Model Created and article written by Rishabh Jain

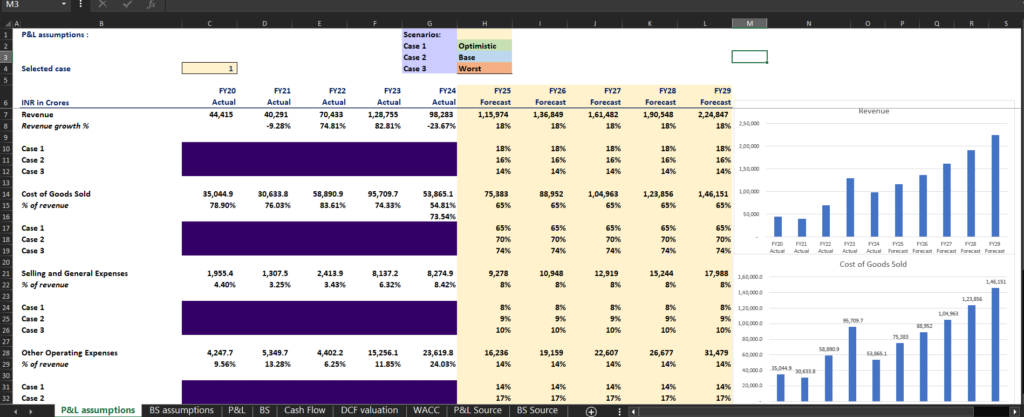

Scenarios & Assumptions :

| Cases | 1 | 2 | 3 |

| Revenue Growth | 18% | 16% | 14% |

| Depreciation and Amortisation (% Revenue) | 2.3% | 2.5% | 3.0% |

| COGS (%Revenue) | 65% | 70% | 74% |

| Current Assets Growth% | 44% | 42% | 40% |

| Current Liabilities Growth% | 46% | 50% | 54% |

| Growth Rate(Terminal Value) | 7% | 7% | 7% |

DCF Model Excel File

DCF Model Excel File :

File Includes:

- Forecasts on Revenue, COGS, R&D Expenses, Depreciation& Amortisation.

- Forecasts on Current Assets & Current Liabilities.

- Calculation of Working Capital, CAPEX, Free Cash-Flows.

- Calculation of Weighted Average Cost of Capital.

- Calculation of DCF Intrinsic Value per share of the company.

- Added Graphs for Visualisation of the data.

Summary and Notes:

- Adani Enterprises is one of the Largest public companies in India with Market Cap around 3.6 Lakh Crore, and Total assets of around 1.6 Lakh Crore.

- Adani Enterprises has Debt/Equity ratio of 1.64. Which means company has 1.6 times more debt than it has Equity making it highly Leveraged. But considering Company is for Building Infrastructure Projects, etc, this debt is Manageable. Specially if company is able to finance debt at lower interest rates which it has been able to in the past. So even though Company has Higher Debt levels, as long as it maintains Lower Interest Rates financing, Long-term Prospects of the company looks good.

- Stock of Adani Enterprises trades at around PE ratio of 87, making it one of the most overpriced stock in the market given its Market cap. PE of 87 is basically Paying 87 Rupees for a stock Earning 1 rupee per aanum, which is quite high given current Market standards.

- WACC came out to be around 11.9%, which is relatively high for the company. It is possible for it to decrease in future years.

- Intrinsic Value per Share came out to be 596 Rupees per share, in optimistic case. Which makes it overvalued with current price, but one of the main reasons the Cash-Flows came out so low was High CAPEX (Capital Expenditure) of the company because of investing in Infrastructure, PPE etc. The Cash-Flows would increase significantly when CAPEX in future is much lower than Cash Flow from Operations.

- Current Price and Value : Market is too optimistic about its Future earnings Prospects. That’s one explaination of high descrepency between Intrinsic Value and Current Share Price.

Disclaimer:

This DCF Model is for Educational and Research purposes ONLY. The DCF model was based on several Assumptions, and it doesn’t Guarentee it will happen in future. This is not in any form a Financial Advice. Do your own Due-Diligence for Investing. For more details visit our Legal Page –https://r1hedge.com/legal/

Other Links:

- DCF Model of Google Alphabet : Google_Alphabet

- Book Recommendations: Book Recommendations